Sikkim has been facing recent scrutiny and speculations from market pundits over the staggering $6B plus trade on commodities. It has been speculated that numerous grey areas have obscured the Income Tax Act in such a tiny State with a population of 6.79 lakh is now an becoming abode for commodity market speculators for its almost tax-haven like status.

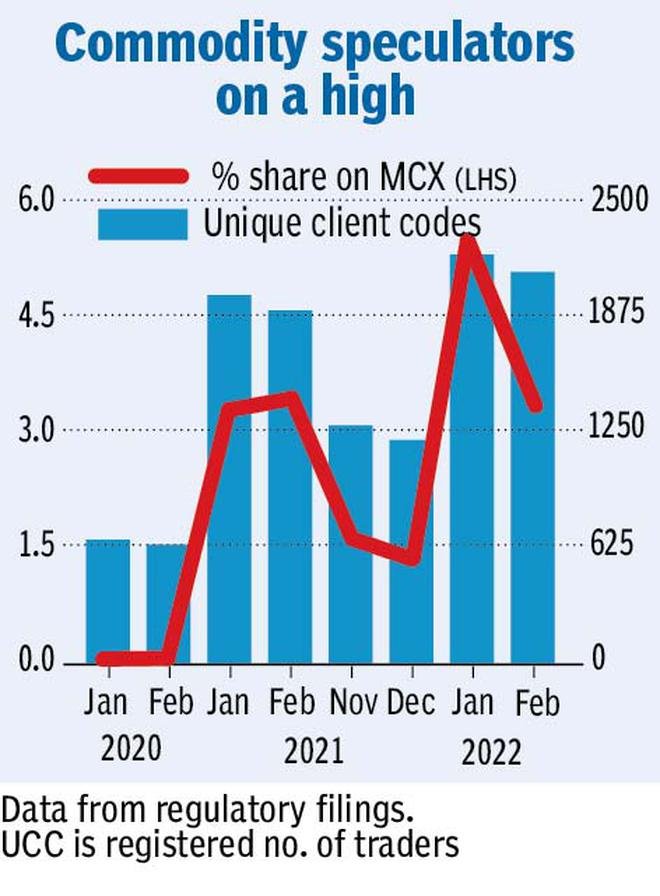

In February, the market share of Sikkim-based traders on the Multi Commodity Exchange (MCX) in Mumbai climbed from zero to 5.46 per cent, this was just over a couple of years’ time frame, taking the commodity speculators on a high tide in the market. Data show that MCX witnessed a total volume churn of over $110 billion on its platform during February, of which Sikkim’s share stood at over $6 billion. Now, Multi Commodity Exchange of India limited is by far the largest, leading and the first listed commodity derivative exchange of the country with a total market share of 92.2% in terms of the value of commodity futures contracts traded in financial year 2021-22 and it facilitates online trading of commodity derivative transaction and functions under the regulatory framework of Securities and Exchange Board of India (SEBI). The MCX offers trading in commodity derivative contracts across varied segments like bullion, industrial metals, energy and agricultural commodities like cardamom etc., and the data shown by such a huge and reputed corporation cannot be ignored.

According to the data released, Sikkim is the only state in the whole North East Indian region that saw such an exponential growth in the MCX’s total turnover contribution. In-fact all other North Eastern states had a total turnover contribution in the MCX below 1% with Assam at 0.33% only behind Sikkim. The number of traders from Sikkim based on unique client code, has increased to 2,217 this year, as compared to 674 in February 2020.

To paint a clearer picture, in comparison to Sikkim other densely populated states see a way lesser volume in the marker, even though they have a larger number of traders. Bihar, as an example, has 2.88 lakh traders but accounts for only 1.51 per cent of the trading volumes. Similarly, Kerala has 2.04 lakh traders but its volume is just around 1.45 per cent. Madhya Pradesh, which has 4.67 lakh traders, accounted for only 3.2 per cent, and the neighboring West Bengal with 2.05 lakh trader shared only 4.14% the total turnover contribution in the MCX in February. These numbers, in comparison to Sikkim, which has a total population of 6.79 lakh is really discombobulating for traders who have been scrutinizing the mind-blowing numbers in Sikkim’s contribution in the commodity market, bringing more scrutiny and speculations from all around the market.

Experts reported that Sikkim’s newfound love for commodity speculation could be due to the exemption its residents get from the mandatory requirement of a Permanent Account Number (PAN), which allows them to skip filing tax returns. Post-2008, market regulator, Securities and Exchange Board of India, (SEBI) exempted Sikkimese residents from the mandatory PAN requirement for investments in the Indian securities market and mutual funds. The traders would only have to give a proof of residency, (Sikkim Subject or COI) to the custodians and exchanges in Mumbai. Following an order by the Sikkim High Court in 2007, SEBI issued via a circular (No: MRD/DOP/MF/Cir-08/2008) to exempt the PAN requirement for Sikkim individuals.

When the Kingdom of Sikkim merged with the Indian union, a condition was laid that its old laws and a special status under Article 371(F) of the India Constitution remained intact. On such condition the tax laws of Sikkim were governed by its own Sikkim Income Tax Manual of 1948 which required none of its residents to pay taxes to the Central Government. However, in 2008 the old tax laws of Sikkim were repealed but the Union Budget that year inserted section 10 (26AAA) in the Income Tax Act of 1961, exempting the residents of Sikkim from tax. It protected the special status given to Sikkim and a word “Sikkimese” was inserted as per Article 371(F) of the Indian Constitution. Thus, according to the section 10 (26AAA) of the Income Tax Act of 1961, “in case of an individual, being a Sikkimese, any income which accrues or arises to him- (a) from any source in the State of Sikkim; or (b) by way of dividend or interest on securities:” were exempted. The exemptions from mandatory requirement of PAN and section 10 (26AAA) of the Income Tax Act, combined to result in a lack of tax filings which therefore made it almost impossible to assess market speculators from Sikkim.

Furthermore, in another serendipitous moment for the commodity traders, in September 2015, the erstwhile commodity market regulator Forwards Market Commission (FMC) which oversaw MCX, merged into SEBI. Therefore, SEBI rules of PAN exemption to Sikkim residents could have also become available to the commodity traders on MCX. What is more baffling is that more than 95% of the trading volumes on MCX is highly concentrated in the commodities like bullions, crude oil, and base metals the price discovery of which largely happens abroad. Experts scrutinize that traders from other states might be using Sikkim-based residents as a proxy to carry out these trades to avoid filing tax returns.

“More than 95 per cent of the trading volume on MCX is concentrated in crude oil, gold, silver and other base metals, the price discovery of which mainly happens abroad. Hence, the activity of Sikkim-based traders on MCX was primarily speculative, experts say adding that traders in other States may be using Sikkim-based residents as a proxy to carry out these trades.”- BusinessLine

“Experts say this laxity of PAN requirement has now come in handy for Sikkim based commodity market traders, who face no urgency of tax filings and thus enjoy a tax haven like status.” – BusinessLine

In 2016, after the demonetization plan of the NDA government was implemented, the State Bank of Sikkim (SBS) which does not fall under the purview of the Reserve Bank of India (RBI) and allows the Sikkimese population to deposit any amount into their bank accounts without providing any KYC documents, saw a huge cash flow through its account holders. The income tax department had to issue many notices at the time along with Government of Sikkim issuing advisories and cautioning Sikkimese not to allow non-Sikkimese to deposit money into their accounts as it may be illegal and amounts to conversion of black money into white. Hurriedly, Income Tax Department (Investigations) had to scan numerous suspicious accounts and make mandatory for all Sikkimese to produce valid KYC documents when they deposited amounts more than 50,000 rupees.

These chain of serendipitous instances perhaps strengthen the argument of Sikkim beginning to act almost as an “offshore financial centre” in India itself where money defaulters in the securities market could enjoy a tax haven like status of the state.

by Rohonit Hang and Paul Rai