MCX Scandal unfurling quick as ROC of exchange recommends a forensic audit

A report by The Hindu, Businessline has informed that the Regulatory Oversight Committee (ROC) , a regulatory body of the Multi Commodity Exchange (MCX) has recommended a forensic audit of various approvals granted by the exchange to traders from Sikkim.

Over the span of past month or two, the state government and the Enforcement Directorate (ED) have started a deep probe into the matter and sought details from MCX with regard to the identity of the traders and other data, the state vigilance has also registered cases under a number of sections to maintain a deep probing investigations after the Chief Minister ordered it.

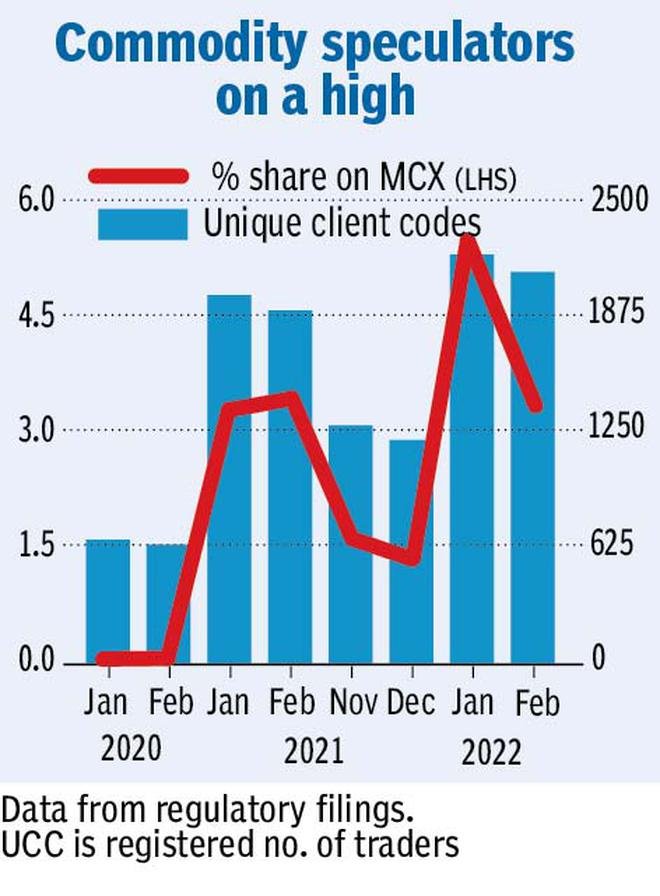

After MCX witnessed trading volumes worth around $6 billion from Sikkim, nearly 5.5 per cent of the total turnover of MCX for February, it became a burning issue of enormous proportions. After which many leaders and parties spoke out and demanded serious enquiry, some even alleging the government and the CM’s involvement in it.

Furthermore, after probes were initiated, the share of Sikkim-based traders on the MCX dropped to just 0.75 per cent in April. Now, according to sources at the Businessline, the ROC of MCX is looking into whether the exchange followed all norms in approving and allowing traders from Sikkim to conduct trade on the exchange platform, the sources said.

According to the report by Businessline, in previous audits, there had been grave lapses discovered:

The exchange has undergone forensic audits earlier, including for unauthorised data sharing and issuing dubious technology contracts. Grave lapses were discovered in both audits and hence, the ROC did not want to take a chance this time, the sources said.

The MCX ROC meeting was held between May 11 and May 13. Key members who made a recommendation for the forensic audit include Shankar Aggarwal, Saurabh Chandra, CS Verma and Suresh Gupta.

Trading volumes from Sikkim on the MCX shot up only during Covid, mainly after the exchange issued a notice about stamp duty waiver to Sikkim-based traders.

All stock and commodity exchanges have to follow rigorous know your client (KYC) procedures before allowing clients to trade, and must also file suspicious transaction reports (STRs) in case of dubious activities. But in the case of Sikkim, the required procedures were lax as the state was given exemptions from vital KYC norms such as PAN requirement.

Sikkim traders on MCX also enjoyed a stamp duty waiver which, tax officials say, implies no urgency for maintaining record of trades from the state. Moreover, the Indian Income Tax Act is not applicable on Sikkim, making it a hot favourite for speculators and hawala operators.

CM Prem Singh Tamang stated that traders from other states were using Sikkim as a base to trade on the MCX. It was also reported that the state government has also learned about brokers and traders from other states being shown as Sikkim residents and an FIR has been registered by Sikkim into the matter.

MCX management in a statement defended its position by saying all the norms were followed and volumes from Sikkim were genuine. The Multi Commodity Exchange (MCX) had refuted all allegations of money laundering and tax evasion by traders registered in Sikkim, stating that the transactions concerned were done through registered PAN cards, the holders of which filed income tax returns regularly.

The Businessline reports that its sources have said, so far the probe has revealed that two clients — Valley Distributors LLP and JMVD Market Solutions, registered with Delhi and Kolkata. The outer states based brokers have emerged as the key suspects who were generating a majority of the Sikkim volumes on MCX. The probe so far has shown that JMVD was a client of Pace Stock Broking and the account of Valley Distributors was with East India Securities.